Tools to Manage Tenants and Leases: A Complete Guide for Modern Property Management

Managing tenants and leases efficiently is one of the biggest challenges faced by landlords, property managers, and real estate companies today. Without the right systems in place, tracking tenant details, lease agreements, rent payments, and compliance deadlines can quickly become overwhelming. This is where tools to manage tenants and leases play a crucial role.

Modern tenant and lease management tools help streamline operations, reduce errors, and improve communication between landlords and tenants. Whether you manage a single rental unit or a large real estate portfolio, adopting the right tools can significantly improve efficiency, transparency, and profitability.

What Are Tools to Manage Tenants and Leases?

Tools to manage tenants and leases are digital solutions—usually software platforms or systems—designed to help property owners and managers handle all tenant-related and lease-related tasks from one centralized location. These tools replace manual record-keeping, spreadsheets, and paper-based processes with automated and secure systems.

They are commonly used to manage:

-

Tenant records and profiles

-

Lease agreements and renewals

-

Rent collection and payment tracking

-

Property occupancy and unit status

-

Communication and notifications

-

Legal compliance and documentation

Why Tools to Manage Tenants and Leases Are Essential

As rental markets become more competitive and regulated, relying on manual methods increases the risk of missed payments, expired leases, and disputes. Here are key reasons why tenant and lease management tools are essential:

1. Improved Organization

All tenant information, lease documents, and payment histories are stored in one place, making it easy to access accurate data anytime.

2. Time and Cost Efficiency

Automation reduces repetitive tasks such as rent reminders, lease renewals, and report generation, saving time and operational costs.

3. Better Tenant Experience

Clear communication, timely notifications, and digital payment options improve tenant satisfaction and retention.

4. Legal and Compliance Support

Tools help track lease expiry dates, security deposits, and compliance requirements, reducing legal risks.

5. Scalable Property Management

Whether managing 5 or 500 units, the right tools grow with your property portfolio.

Key Features of Tools to Manage Tenants and Leases

When choosing the best tools to manage tenants and leases, look for the following essential features:

Tenant Management

-

Centralized tenant profiles

-

Contact details and identification records

-

Move-in and move-out tracking

-

Tenant history and occupancy status

Lease Management

-

Digital lease creation and storage

-

Lease start and end date tracking

-

Automated renewal alerts

-

Rent escalation and clause tracking

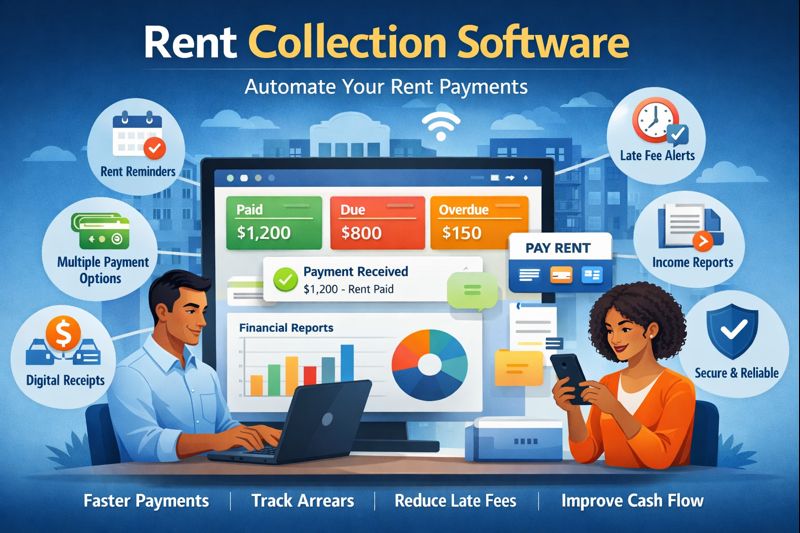

Rent and Payment Tracking

-

Online rent collection

-

Automated payment reminders

-

Arrears and late fee management

-

Payment history reports

Communication Tools

-

Bulk SMS or email notifications

-

Maintenance and notice alerts

-

Tenant communication logs

Reporting and Analytics

-

Lease status reports

-

Tenant occupancy reports

-

Rent collection summaries

-

Financial and performance insights

Benefits of Using Digital Tools to Manage Tenants and Leases

Reduced Errors

Automated calculations and data validation reduce human errors common in manual record-keeping.

Increased Transparency

Clear records of leases, payments, and communications help build trust between landlords and tenants.

Faster Decision-Making

Real-time reports and dashboards allow property managers to make informed decisions quickly.

Enhanced Security

Digital tools offer secure data storage, access controls, and backups, protecting sensitive tenant information.

Who Should Use Tools to Manage Tenants and Leases?

These tools are ideal for:

-

Individual landlords

-

Property management companies

-

Real estate agents

-

Housing associations

-

Commercial property managers

-

Student housing and serviced apartment providers

Whether you manage residential or commercial properties, tenant and lease management tools simplify day-to-day operations.

Choosing the Right Tools to Manage Tenants and Leases

When selecting a tenant and lease management tool, consider:

-

Ease of use and setup

-

Local market suitability and compliance

-

Mobile and cloud accessibility

-

Integration with rent collection systems

-

Customer support and scalability

A good tool should adapt to your property management workflow rather than complicate it.

The Future of Tenant and Lease Management

With the rise of smart property management, tools to manage tenants and leases are becoming more advanced. Features such as mobile apps, automated compliance checks, digital signatures, and AI-powered insights are transforming how landlords and property managers operate.

Investing in the right tools today prepares you for future growth, regulatory changes, and evolving tenant expectations.

Conclusion

Using reliable tools to manage tenants and leases is no longer optional—it is essential for efficient, professional, and scalable property management. These tools help organize tenant data, automate lease tracking, improve rent collection, and enhance communication, all while reducing risk and saving time.

Whether you are a small landlord or a large property manager, adopting the right tenant and lease management tools will improve efficiency, increase transparency, and support long-term success in real estate management.