Landlord Accounting Kit: The Complete Financial Management Solution for Property Owners

Managing rental properties goes far beyond collecting rent. Landlords must track income, record expenses, manage taxes, reconcile payments, and generate accurate financial reports. Without a structured system, accounting can quickly become overwhelming and error-prone. This is where a landlord accounting kit becomes an essential tool.

A landlord accounting kit provides an all-in-one framework for managing rental finances efficiently, ensuring compliance, transparency, and profitability. Whether you own a single rental unit or manage a large property portfolio, a well-designed landlord landlordaccounting kit helps you stay organized and financially confident.

What Is a Landlord Accounting Kit?

A landlord accounting kit is a collection of tools, templates, and systems designed specifically for tracking and managing rental property finances. It typically includes:

-

Rent tracking tools

-

Expense and maintenance cost records

-

Profit and loss statements

-

Tax preparation templates

-

Financial reporting dashboards

-

Tenant payment reconciliation tools

Unlike generic accounting software, a landlord accounting kit is tailored to the unique financial needs of rental property management.

Why Every Landlord Needs an Accounting Kit

1. Accurate Rent Tracking

Missed or misrecorded payments can create disputes and financial gaps. A landlord accounting kit ensures every rent payment is logged accurately, including late fees, partial payments, and arrears.

2. Clear Expense Management

From repairs and maintenance to utilities and property taxes, expenses add up quickly. A landlord accounting kit categorizes and tracks all costs, making it easier to understand where your money goes.

3. Simplified Tax Preparation

Rental income is taxable, but so are deductible expenses. A landlord accounting kit keeps tax-ready records, reducing stress during tax season and minimizing the risk of errors.

4. Financial Transparency

Whether for personal insight or external reporting, landlords benefit from clear financial visibility. A landlord accounting kit generates reports that show profitability per property or unit.

5. Time and Cost Efficiency

Manual spreadsheets and paper records consume time and increase mistakes. An accounting kit automates repetitive tasks, saving time and reducing accounting costs.

Key Components of a Landlord Accounting Kit

Rent Income Tracker

Tracks:

-

Monthly rent payments

-

Late fees

-

Outstanding balances

-

Payment methods (cash, bank transfer, mobile money)

Expense Tracking System

Records:

-

Maintenance and repairs

-

Utilities and service charges

-

Property management fees

-

Insurance and property taxes

Profit and Loss Statements

Automatically calculates:

-

Net rental income

-

Operating expenses

-

Monthly and annual profits

Tax Reporting Tools

Includes:

-

Expense deduction summaries

-

Rental income breakdowns

-

Annual tax reports

Tenant Ledger

Maintains:

-

Individual tenant payment history

-

Deposit records

-

Refund and adjustment logs

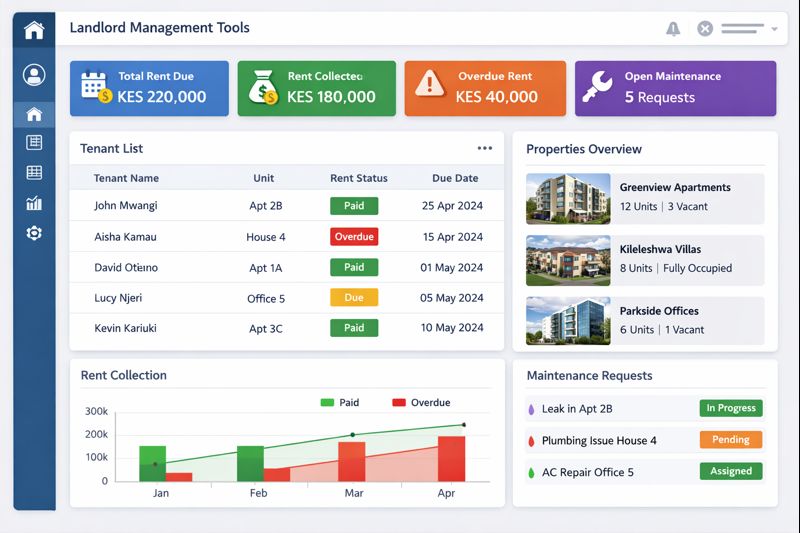

Financial Dashboards

Visual summaries of:

-

Cash flow

-

Property performance

-

Occupancy and revenue trends

Who Should Use a Landlord Accounting Kit?

-

Independent landlords with one or more rental units

-

Property managers handling multiple properties

-

Real estate investors tracking portfolio performance

-

Short-term rental hosts managing frequent transactions

-

Landlords in emerging markets needing mobile-friendly accounting tools

Benefits of Using a landlord accounting

Improved Cash Flow Control

Know exactly how much money is coming in and going out at any time.

Reduced Financial Errors

Automated calculations eliminate common accounting mistakes.

Better Decision-Making

Financial insights help landlords adjust rent pricing, control costs, and plan investments.

Professional Record Keeping

Well-organized financial records improve credibility with banks, partners, and tax authorities.

Scalable Financial Management

As your property portfolio grows, a landlord accounting kit grows with you.

Digital vs Manual Landlord Accounting Kits

Manual Accounting Kits

-

Spreadsheet-based

-

Low upfront cost

-

Higher risk of errors

-

Time-consuming updates

Digital Landlord Accounting Kits

-

Automated calculations

-

Cloud-based access

-

Real-time reporting

-

Secure data storage

For modern landlords, a digital landlord accounting kit offers better efficiency, accuracy, and scalability.

How to Choose the Best Landlord Accounting Kit

When selecting a landlord accounting kit, consider:

-

Ease of use

-

Customization options

-

Multi-property support

-

Tax compliance features

-

Reporting and export tools

-

Integration with rent collection systems

A good landlord accounting kit should adapt to your local tax rules and payment methods.

Landlord Accounting Kit for Growing Property Businesses

As rental portfolios expand, financial management becomes more complex. A landlord accounting kit helps landlords transition from informal record-keeping to professional-grade financial management.

With the right accounting kit, landlords can:

-

Track performance per property

-

Compare income trends

-

Identify underperforming units

-

Plan future investments

Common Mistakes Landlords Make Without an Accounting Kit

-

Mixing personal and rental finances

-

Losing receipts and expense records

-

Underreporting income or deductions

-

Failing to track late payments

-

Lacking clear financial summaries

A landlord accounting kit prevents these costly mistakes by centralizing all financial data.

Future of Landlord Accounting Kits

Modern landlord accounting kits are evolving with features such as:

-

Mobile access

-

Automated tax calculations

-

Cloud-based backups

-

Integration with tenant portals

-

AI-powered financial insights

These innovations make accounting simpler and more accessible for landlords at all levels.

Conclusion

A landlord accounting kit is no longer optional—it is a necessity for efficient, compliant, and profitable property management. By providing structured financial tracking, accurate reporting, and tax-ready records, a landlord accounting kit empowers landlords to take full control of their rental finances.

Whether you manage a single rental unit or a growing portfolio, investing in a landlord accounting kit will save time, reduce errors, and improve long-term profitability.

Leave a Reply