Estate Financial Reporting Tools: Simplify Estate Accounting and Compliance

Managing estate finances requires accuracy, transparency, and compliance. Estate financial reporting tools provide executors, administrators, trustees, and legal professionals with a reliable way to track assets, liabilities, income, and expenses throughout the estate administration process. These tools replace complex spreadsheets with structured, audit-ready reports that meet legal and regulatory requirements.

Whether you are handling a small family estate or a large multi-asset portfolio, modern estate financial reporting tools streamline workflows, reduce errors, and ensure timely reporting to beneficiaries, courts, and tax authorities.

What Are Estate Financial Reporting Tools?

Estate financial reporting tools are digital solutions designed to organize, analyze, and present financial data related to estate administration. They consolidate all estate transactions into clear reports that reflect the true financial position of the estate.

These tools typically include:

-

Asset and liability tracking

-

Income and expense categorization

-

Beneficiary distribution reports

-

Cash flow summaries

-

Compliance-ready financial statements

By centralizing data, estate financial reporting tools ensure consistency, accuracy, and accountability at every stage of administration.

Why Estate Financial Reporting Tools Are Essential

Estate administration often involves multiple stakeholders, strict timelines, and legal oversight. Manual methods increase the risk of errors and disputes. Estate financial reporting tools help eliminate these challenges by providing structured, transparent reporting.

Key Benefits

-

Accuracy: Automated calculations reduce human error

-

Transparency: Clear reports improve trust with beneficiaries

-

Compliance: Supports court, tax, and probate requirements

-

Efficiency: Saves time compared to spreadsheets or paper records

-

Audit Readiness: Maintains a complete transaction history

Using estate financial reporting tools allows administrators to focus on decision-making rather than data reconciliation.

Core Features of Estate Financial Reporting Tools

1. Asset and Liability Reporting

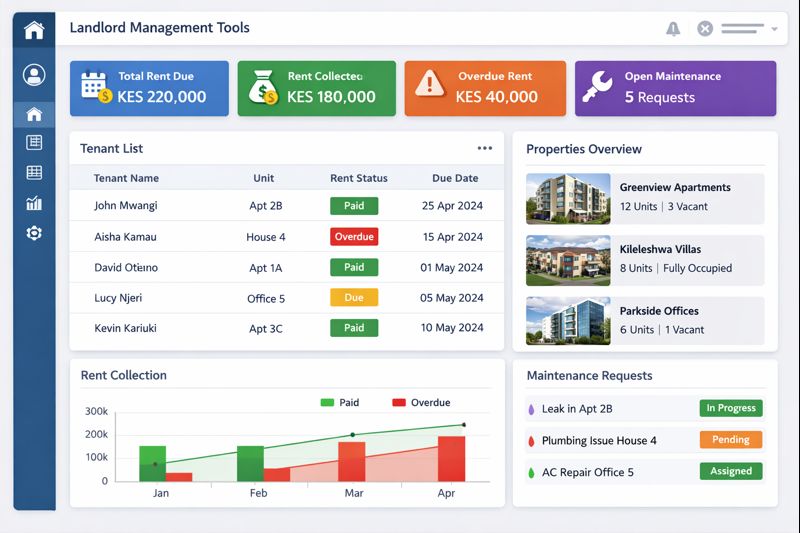

Track real estate, bank accounts, investments, debts, and obligations in one system. Estate financial reporting tools provide a real-time snapshot of estate value.

2. Income and Expense Tracking

Record rental income, dividends, interest, legal fees, taxes, and maintenance costs. Categorized expenses ensure accurate financial summaries.

3. Cash Flow Statements

Monitor incoming and outgoing funds to maintain liquidity throughout estate administration.

4. Beneficiary Distribution Reports

Generate clear breakdowns showing how assets and funds are allocated among beneficiaries.

5. Compliance and Audit Reports

Produce standardized financial reports that meet probate court and regulatory standards.

Who Should Use Estate Financial Reporting Tools?

Estate financial reporting tools are valuable for:

-

Executors and estate administrators

-

Trustees managing ongoing trusts

-

Probate attorneys and law firms

-

Financial advisors and accountants

-

Professional estate management firms

These tools are especially useful for estates involving multiple assets, long administration periods, or complex beneficiary structures.

Estate Financial Reporting Tools vs Manual Accounting

| Feature | Manual Accounting | Estate Financial Reporting Tools |

|---|---|---|

| Accuracy | Error-prone | Automated & precise |

| Time Efficiency | Time-consuming | Streamlined workflows |

| Transparency | Limited | Clear, shareable reports |

| Compliance | High risk | Built-in compliance support |

| Scalability | Poor | Handles complex estates |

Modern estate financial reporting tools outperform manual methods in every critical area.

Improving Compliance With Estate Financial Reporting Tools

Legal and tax compliance is a major concern in estate administration. Estate financial reporting tools help by:

-

Maintaining detailed transaction logs

-

Supporting standardized financial statements

-

Simplifying tax preparation and filings

-

Ensuring accurate beneficiary accounting

This level of compliance reduces legal risks and protects administrators from disputes or penalties.

Choosing the Right Estate Financial Reporting Tools

When selecting estate financial reporting tools, consider:

-

Ease of use and learning curve

-

Customizable reporting templates

-

Secure data storage and access control

-

Integration with estate accounting systems

-

Scalability for complex or long-term estates

The right tool should adapt to your estate’s size and reporting requirements.

The Future of Estate Financial Reporting Tools

As estate management becomes more digital, estate financial reporting tools are evolving with:

-

Real-time dashboards

-

Cloud-based access

-

Automated compliance checks

-

Integration with legal and accounting platforms

These advancements are transforming estate administration into a more transparent, efficient, and accountable process.

Final Thoughts

Estate financial reporting tools are no longer optional for modern estate administration. They provide clarity, accuracy, and compliance while significantly reducing administrative burden. By adopting professional estate financial reporting tools, executors and trustees can deliver reliable financial insights, protect themselves legally, and ensure fair, transparent outcomes for all beneficiaries.