Estate Admin Kit for Trustees: Simplifying Trust & Estate Administration

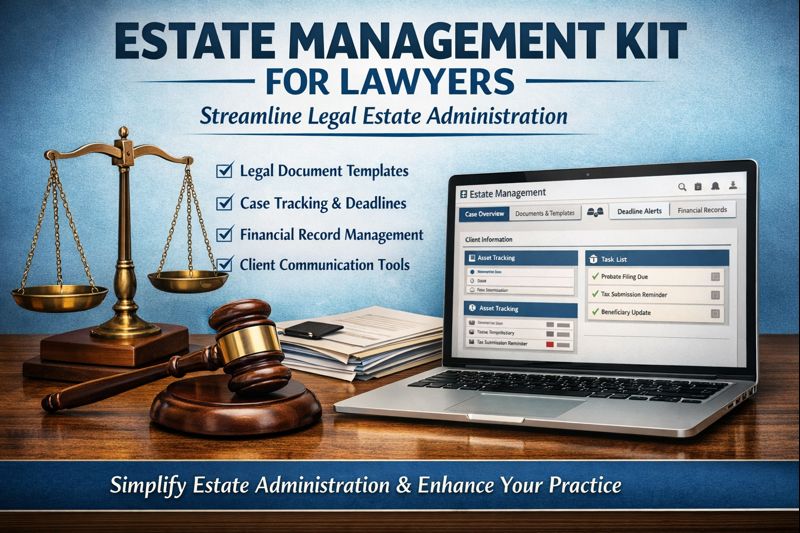

Managing an estate as a trustee can be complex, time-consuming, and legally demanding. An estate admin kit for trustees provides a structured, digital solution that simplifies trust administration, estate documentation, asset tracking, and compliance—all in one secure system.

Whether you are a professional trustee, family trustee, lawyer, or financial advisor, an estate admin kit helps you fulfill fiduciary duties efficiently while minimizing errors and legal risks.

What Is an Estate Admin Kit for Trustees?

An estate admin kit for trustees is a comprehensive toolkit—often digital or cloud-based—designed to help trustees manage all aspects of estate and trust administration. It centralizes records, automates workflows, and ensures compliance with legal and financial obligations.

Unlike manual filing systems, modern estate admin kits offer structured templates, secure storage, and step-by-step guidance for trustees handling estates of any size.

Why Trustees Need an Estate Admin Kit

Trustees are legally obligated to act in the best interests of beneficiaries. This includes accurate record-keeping, timely reporting, and transparent administration. An estate admin kit for trustees helps by:

-

Reducing administrative burden

-

Ensuring compliance with trust laws

-

Preventing missed deadlines

-

Improving transparency for beneficiaries

-

Protecting trustees from liability

With increasing regulatory scrutiny, using a professional estate admin kit is no longer optional—it’s essential.

Key Features of an Estate Admin Kit for Trustees

1. Centralized Estate Documentation

Store wills, trust deeds, asset records, court documents, tax filings, and correspondence in one secure location.

2. Asset & Liability Tracking

Easily record, monitor, and update estate assets, investments, debts, and liabilities in real time.

3. Trustee Task Management

Track trustee duties, deadlines, and milestones to ensure timely estate settlement and compliance.

4. Beneficiary Records & Communication

Maintain beneficiary details, distribution schedules, and communication logs for full transparency.

5. Financial Reporting & Accounting

Generate trustee reports, expense summaries, and estate accounts with minimal manual effort.

6. Compliance & Audit Readiness

Built-in checklists and workflows help trustees meet legal, tax, and regulatory requirements.

7. Secure Cloud Access

Modern estate admin kits offer encrypted, cloud-based access, allowing trustees to manage estates remotely.

Benefits of Using an Estate Admin Kit for Trustees

✔ Improved Accuracy

Standardized templates and automation reduce human error.

✔ Time Efficiency

Trustees can manage estates faster without juggling spreadsheets and paper files.

✔ Legal Protection

Clear records and audit trails protect trustees from disputes and legal claims.

✔ Better Beneficiary Trust

Transparent reporting builds confidence and reduces conflicts.

✔ Scalable for Multiple Estates

Professional trustees can manage multiple trusts from a single platform.

Who Should Use an Estate Admin Kit for Trustees?

An estate admin kit is ideal for:

-

Professional trustees

-

Family and private trustees

-

Estate lawyers and probate professionals

-

Trust administrators

-

Financial advisors managing trusts

-

Executors acting in trustee roles

Whether handling a simple family trust or a complex multi-asset estate, this kit adapts to your needs.

Digital vs Manual Estate Administration

| Manual Administration | Estate Admin Kit for Trustees |

|---|---|

| Paper files & spreadsheets | Centralized digital dashboard |

| High risk of errors | Automated, structured workflows |

| Time-consuming reporting | Instant reports & summaries |

| Difficult compliance tracking | Built-in compliance tools |

| Limited transparency | Clear audit trails |

A digital estate admin kit clearly outperforms traditional methods in efficiency and reliability.

How an Estate Admin Kit Supports Trustee Compliance

Trustees must comply with strict legal and fiduciary standards. An estate admin kit for trustees helps by:

-

Tracking statutory deadlines

-

Maintaining accurate financial records

-

Documenting trustee decisions

-

Supporting tax and audit preparation

-

Ensuring proper asset distribution

This reduces the risk of penalties, disputes, and personal liability.

Choosing the Right Estate Admin Kit for Trustees

When selecting an estate admin kit, look for:

-

Trustee-specific features

-

Secure data encryption

-

Cloud-based accessibility

-

Easy reporting tools

-

Scalability for multiple trusts

-

User-friendly interface

A well-designed estate admin kit should guide trustees step-by-step through the entire administration process.

Why an Estate Admin Kit Is Essential for Modern Trustees

Estate and trust administration is becoming more complex, not less. Beneficiaries expect transparency, regulators demand compliance, and trustees face increased accountability. An estate admin kit for trustees equips you with the tools needed to manage estates professionally, efficiently, and confidently.

Final Thoughts

An estate admin kit for trustees is more than just software—it’s a complete trust administration solution. By centralizing records, automating tasks, and supporting compliance, it empowers trustees to fulfill their fiduciary duties with confidence and clarity.

If you want to reduce administrative stress, improve accuracy, and protect yourself as a trustee, investing in a professional estate admin kit is the smart choice.

Estate Admin Kit for Trustees: Complete Guide to Simplified Trust & Estate Administration

Managing an estate as a trustee can be overwhelming. From handling assets to filing taxes and communicating with beneficiaries, trustees face a wide range of responsibilities—and mistakes can lead to legal liability. That’s where an estate admin kit for trustees comes in.

This guide explains everything you need to know about using an estate admin kit, why it’s essential, and how it transforms estate management for trustees.

What Is an Estate Admin Kit for Trustees?

An estate admin kit for trustees is a comprehensive toolkit—usually digital—that helps trustees manage all aspects of estate administration efficiently. It combines:

-

Estate record keeping

-

Trust documentation

-

Financial tracking

-

Compliance monitoring

-

Beneficiary communication

Modern kits provide cloud-based access, task automation, secure storage, and templates tailored specifically for trustees. Essentially, it’s a “trustee’s command center,” enabling smooth administration from start to finish.

Why Trustees Need an Estate Admin Kit

Trustees are responsible for acting in the best interests of beneficiaries. Fulfilling this fiduciary duty requires precise record-keeping, timely reporting, and transparency.

An estate admin kit for trustees simplifies this by:

-

Streamlining estate workflows

-

Minimizing administrative errors

-

Reducing legal risk

-

Enhancing transparency for beneficiaries

-

Ensuring timely compliance with laws and regulations

With estates becoming more complex, digital solutions are no longer optional—they are essential for modern trustees.

Key Features of an Estate Admin Kit for Trustees

Here’s what a high-quality kit should offer:

1. Centralized Document Management

-

Store wills, trust deeds, property titles, tax documents, and correspondence in one secure location.

-

Easily share access with authorized users, avoiding lost files or duplication.

2. Asset & Liability Tracking

-

Monitor real estate, investments, bank accounts, and debts.

-

Track changes in asset value and receive alerts for important deadlines.

3. Trustee Task Management

-

Assign and track tasks related to probate, tax filings, and estate settlements.

-

Automated reminders help prevent missed deadlines.

4. Beneficiary Records & Communication

-

Maintain detailed records of beneficiaries.

-

Schedule distributions and document communications to ensure transparency.

5. Financial Reporting & Accounting

-

Generate accurate trustee accounts, expense reports, and summaries.

-

Easily export reports for legal, audit, or tax purposes.

6. Compliance & Audit Readiness

-

Built-in checklists ensure legal and tax compliance.

-

Create audit-ready reports that protect trustees from liability.

7. Secure Cloud Access

-

Encrypted storage ensures data security.

-

Remote access allows trustees to manage estates from anywhere.

How an Estate Admin Kit Saves Trustees Time and Effort

Manual estate management is time-consuming, error-prone, and stressful. An estate admin kit automates repetitive tasks, standardizes processes, and provides a clear roadmap for administration.

For example, instead of manually tracking deadlines for multiple estates, a trustee can use automated notifications. Instead of manually preparing beneficiary reports, the kit generates them instantly.

The result: more accurate administration, reduced stress, and more time to focus on strategic decisions for beneficiaries.

Digital vs Manual Estate Administration

| Manual Administration | Estate Admin Kit for Trustees |

|---|---|

| Paper files, spreadsheets, scattered documents | Centralized digital dashboard |

| High risk of human error | Standardized workflows & automation |

| Time-intensive reporting | Instant, accurate reports |

| Hard to track compliance | Built-in compliance tools |

| Limited visibility for beneficiaries | Transparent audit trail |

The efficiency and accuracy gains make a digital estate admin kit a must-have for trustees managing multiple estates.

Legal Compliance Made Easy

Trustees have legal obligations under trust law, including:

-

Accurate record-keeping

-

Timely distribution of assets

-

Reporting to beneficiaries and courts

-

Compliance with tax regulations

An estate admin kit guides trustees through these obligations, ensuring every step is documented and compliant. This reduces risk and protects trustees from potential disputes or penalties.

Choosing the Right Estate Admin Kit for Trustees

When evaluating estate admin kits, consider:

-

Trustee-specific features – Look for templates, checklists, and workflows tailored to trust administration.

-

Secure cloud access – Ensure encryption and multi-factor authentication.

-

Ease of reporting – Financial statements, audit trails, and beneficiary reports should be simple to generate.

-

Scalability – Can the system handle multiple estates or large, complex trusts?

-

User-friendly interface – Trustees should be able to navigate the system easily, even without advanced tech skills.

-

Customer support & training – Reliable support ensures you maximize the kit’s potential.

Benefits of Using an Estate Admin Kit for Trustees

-

Accuracy: Automated workflows reduce human error.

-

Efficiency: Saves hours of manual work and tracking.

-

Legal protection: Maintains audit trails for liability protection.

-

Transparency: Builds trust with beneficiaries through clear communication.

-

Scalability: Manage multiple estates or trusts efficiently.

Step-by-Step Trustee Workflow Using an Estate Admin Kit

-

Setup Estate Profiles – Upload documents, enter assets, and list beneficiaries.

-

Assign Tasks – Schedule deadlines for tax filings, property management, and distributions.

-

Track Assets & Liabilities – Monitor updates in real time.

-

Generate Reports – Produce financial and compliance reports for beneficiaries or courts.

-

Communicate with Beneficiaries – Document messages, updates, and approvals.

-

Close Estate – Verify all tasks are complete, generate final reports, and archive securely.

Who Can Benefit From an Estate Admin Kit?

-

Professional Trustees – Manage multiple estates efficiently.

-

Family Trustees – Ensure smooth administration without professional help.

-

Estate Lawyers & Probate Professionals – Streamline client case management.

-

Trust Administrators – Reduce errors and liability risk.

-

Financial Advisors – Track assets and compliance for client trusts.

FAQ: Estate Admin Kit for Trustees

Q1: Is an estate admin kit suitable for small estates?

Yes. Even small estates benefit from structured tracking, secure storage, and automated reporting.

Q2: Can multiple trustees access the kit simultaneously?

Most digital kits offer multi-user access with role-based permissions, allowing collaboration while protecting sensitive data.

Q3: How secure is an estate admin kit?

Reputable kits use encryption, secure cloud storage, and multi-factor authentication to protect sensitive estate information.

Q4: Can it handle tax and legal compliance?

Yes. Built-in templates, checklists, and reminders help trustees meet regulatory obligations efficiently.

Q5: Is training required?

Most kits are user-friendly, but training or onboarding is recommended for first-time users to fully utilize all features.

Final Thoughts

An estate admin kit for trustees is more than software—it’s a complete solution for managing trust and estate administration professionally. By centralizing records, automating workflows, and supporting compliance, trustees can reduce stress, prevent errors, and protect themselves from legal risks.

In today’s complex estate landscape, using a digital estate admin kit isn’t just smart—it’s essential.