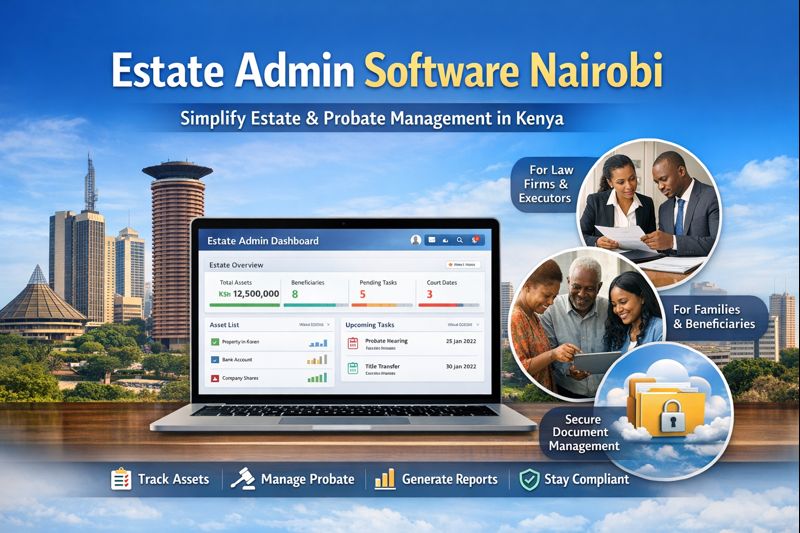

Estate Admin Software for Lawyers: Streamline Probate, Trust & Estate Management

Estate admin software for lawyers is transforming how legal professionals manage probate, trusts, wills, and estate administration. As estates grow more complex and compliance requirements tighten, law firms need a secure, efficient, and centralized solution to handle estate matters accurately and on time.

Whether you’re a solo practitioner, probate lawyer, or part of a large law firm, estate administration software helps reduce manual workload, minimize errors, and ensure full legal compliance—while improving client satisfaction.

What Is Estate Admin Software for Lawyers?

Estate admin software for lawyers is a specialized digital platform designed to manage all aspects of estate administration and probate law. It automates key legal processes such as:

-

Probate case tracking

-

Will and trust document management

-

Asset and liability inventories

-

Beneficiary records

-

Court filing deadlines and compliance

-

Estate accounting and reporting

By consolidating estate data into a single system, lawyers can manage multiple estates more efficiently while maintaining accurate legal records.

Why Lawyers Need Estate Administration Software

1. Improve Efficiency in Probate & Estate Cases

Manual estate administration is time-consuming and error-prone. Estate admin software automates repetitive tasks, allowing lawyers to focus on legal strategy and client advisory rather than paperwork.

2. Ensure Legal Compliance

Estate administration involves strict court deadlines, regulatory requirements, and fiduciary duties. Estate admin software for lawyers helps track filings, deadlines, and statutory obligations to reduce compliance risks.

3. Centralized Case & Document Management

Store wills, trust deeds, court orders, correspondence, and financial statements in one secure location—accessible anytime, anywhere.

4. Reduce Errors & Risk

Automated calculations, standardized workflows, and audit trails help minimize costly mistakes and protect law firms from liability.

Key Features of Estate Admin Software for Lawyers

Case & Probate Management

-

Manage multiple estate cases in one dashboard

-

Track probate stages from filing to closure

-

Monitor deadlines, court dates, and tasks

Estate Accounting & Financial Tracking

-

Track estate assets, debts, and distributions

-

Generate estate accounting reports

-

Maintain transparent financial records for beneficiaries and courts

Document Automation & Storage

-

Secure storage for wills, trusts, and legal filings

-

Automated document templates for estate forms

-

Easy retrieval for audits or court reviews

Beneficiary & Client Management

-

Maintain accurate beneficiary records

-

Track distributions and approvals

-

Improve client communication and reporting

Security & Audit Trails

-

Role-based access control

-

Complete audit logs for fiduciary accountability

-

Data encryption and secure backups

Benefits of Estate Admin Software for Law Firms

-

Faster probate case resolution

-

Lower administrative costs

-

Improved accuracy and transparency

-

Enhanced client trust and satisfaction

-

Scalable solution for growing legal practices

Estate admin software for lawyers ensures law firms can manage estates professionally while meeting ethical and legal obligations.

Who Should Use Estate Admin Software?

-

Probate lawyers

-

Estate planning attorneys

-

Trust administrators

-

Corporate law firms handling estates

-

Solo legal practitioners managing probate cases

Choosing the Best Estate Admin Software for Lawyers

When selecting estate admin software, lawyers should consider:

-

Legal compliance support

-

Ease of use

-

Secure cloud access

-

Customizable workflows

-

Reliable customer support

The right estate administration software should integrate seamlessly into your legal practice while supporting long-term growth.

Estate Admin Software for Lawyers: The Future of Estate Law Practice

As estate cases increase and client expectations rise, estate admin software for lawyers is no longer optional—it’s essential. By adopting the right platform, law firms can deliver faster, more accurate, and more compliant estate administration services.

Estate Admin Software for Lawyers: The Complete Guide to Modern Probate and Estate Management

Estate admin software for lawyers has become an essential tool in today’s legal environment. As probate laws grow more complex and clients demand faster, more transparent services, traditional manual estate administration methods are no longer sufficient. Lawyers handling estates, trusts, and probate matters must manage extensive documentation, strict court deadlines, financial records, and fiduciary responsibilities—all while ensuring legal compliance.

This comprehensive guide explains what estate admin software for lawyers is, how it works, its benefits, key features, use cases, and how to choose the best solution for your legal practice.

Understanding Estate Administration in Legal Practice

Estate administration is the legal process of managing and distributing a deceased person’s assets according to a will or applicable law. Lawyers play a critical role in:

-

Filing probate applications

-

Validating wills and trusts

-

Managing estate assets and liabilities

-

Paying debts and taxes

-

Distributing assets to beneficiaries

-

Preparing estate accounts for courts and heirs

Each step requires precision, compliance, and proper documentation. Estate admin software for lawyers digitizes and streamlines this entire process.

What Is Estate Admin Software for Lawyers?

Estate admin software for lawyers is a specialized legal technology solution designed to support probate and estate administration workflows. Unlike general case management systems, this software focuses specifically on estate-related legal processes.

It centralizes estate data, automates repetitive tasks, and provides tools for compliance, accounting, and reporting—helping lawyers manage estates efficiently from start to finish.

Why Estate Admin Software Is Essential for Lawyers

Increasing Complexity of Estate Law

Modern estates often involve multiple assets, cross-border properties, business interests, digital assets, and multiple beneficiaries. Managing this complexity manually increases the risk of errors and delays.

High Compliance & Fiduciary Obligations

Lawyers handling estates are fiduciaries with strict ethical and legal duties. Estate admin software ensures accurate record-keeping, audit trails, and transparent reporting.

Growing Client Expectations

Clients expect real-time updates, clear communication, and faster resolutions. Estate administration software enables lawyers to deliver professional, transparent service.

Key Features of Estate Admin Software for Lawyers

1. Probate Case Management

-

Track estate cases from initiation to closure

-

Manage timelines, court dates, and statutory deadlines

-

Assign tasks to legal staff and monitor progress

This ensures no deadlines are missed and all legal requirements are fulfilled.

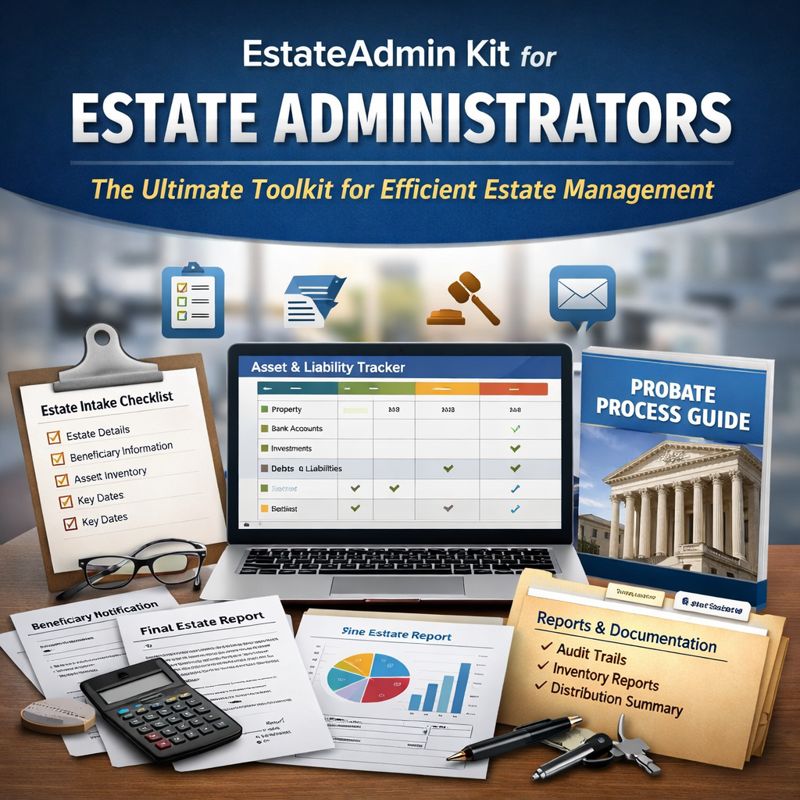

2. Estate Accounting & Financial Management

-

Record estate assets, liabilities, income, and expenses

-

Track payments, distributions, and balances

-

Generate court-ready estate accounting reports

Accurate estate accounting is one of the most critical aspects of probate law, and automation significantly reduces errors.

3. Document Management & Automation

-

Secure storage for wills, trusts, court filings, and correspondence

-

Automated document templates for probate forms

-

Version control and easy document retrieval

Lawyers can quickly access documents for court hearings, audits, or client meetings.

4. Beneficiary & Client Records

-

Maintain detailed beneficiary information

-

Track approvals, distributions, and communications

-

Provide transparent records for beneficiaries

This reduces disputes and builds trust between lawyers and clients.

5. Compliance Tracking & Audit Trails

-

Built-in compliance checklists

-

Automated reminders for legal deadlines

-

Complete audit logs for fiduciary accountability

Estate admin software for lawyers protects firms from compliance risks and professional liability.

6. Secure Cloud Access

-

Access estate data securely from anywhere

-

Role-based permissions for staff and partners

-

Encrypted data storage and backups

Cloud-based estate administration software supports remote work and collaboration.

Benefits of Estate Admin Software for Lawyers

Increased Efficiency

Automating repetitive tasks reduces administrative workload and allows lawyers to focus on legal analysis and client advisory.

Reduced Risk & Errors

Built-in workflows, validations, and audit trails help prevent costly mistakes.

Better Client Experience

Clear reporting, faster responses, and transparent estate management improve client satisfaction.

Scalability for Law Firms

Estate admin software allows firms to handle more cases without increasing staff costs.

Improved Profitability

Efficient estate administration reduces overhead and improves case turnaround time.

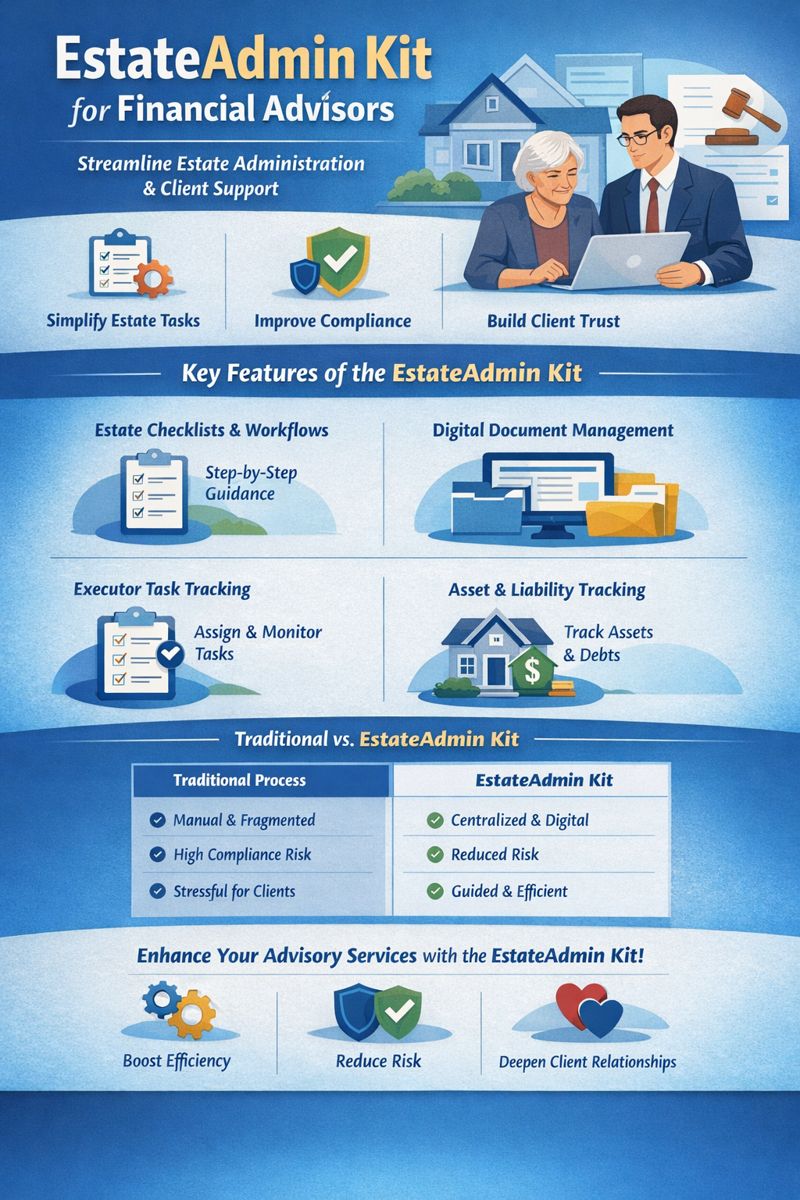

Estate Admin Software vs Manual Estate Administration

| Manual Process | Estate Admin Software |

|---|---|

| Paper files | Centralized digital records |

| Manual calculations | Automated estate accounting |

| Missed deadlines risk | Automated reminders |

| Limited transparency | Real-time reporting |

| Time-consuming | Streamlined workflows |

The difference is clear: estate admin software for lawyers modernizes estate practice.

Who Should Use Estate Admin Software?

-

Probate lawyers

-

Estate planning attorneys

-

Trust administrators

-

Law firms handling succession matters

-

Solo practitioners managing multiple estates

Whether handling small estates or complex trust portfolios, the software adapts to different practice sizes.

Use Cases for Estate Admin Software for Lawyers

Probate Case Management

Manage court filings, asset inventories, and beneficiary distributions in one system.

Trust Administration

Track trust assets, distributions, and compliance obligations.

Estate Litigation Support

Maintain accurate records and timelines for disputed estates.

Corporate & High-Net-Worth Estates

Handle complex asset structures and multiple stakeholders efficiently.

How Estate Admin Software Improves Compliance

Compliance is one of the biggest risks in estate law. Estate admin software for lawyers helps by:

-

Tracking statutory deadlines

-

Maintaining complete financial records

-

Providing audit-ready documentation

-

Supporting fiduciary accountability

This protects both lawyers and their clients.

Choosing the Best Estate Admin Software for Lawyers

When selecting estate admin software, consider the following factors:

Ease of Use

The software should be intuitive for lawyers and legal staff.

Legal Compliance Support

Ensure it supports probate laws and estate administration standards.

Customization

Look for flexible workflows and reporting options.

Security & Privacy

Estate data is highly sensitive—strong security is essential.

Customer Support

Reliable support ensures smooth onboarding and ongoing use.

Cloud-Based vs On-Premise Estate Admin Software

Cloud-Based Software

-

Lower upfront costs

-

Automatic updates

-

Remote accessibility

On-Premise Software

-

Higher initial investment

-

Limited remote access

-

Requires in-house IT management

Most modern law firms prefer cloud-based estate admin software for lawyers.

The Future of Estate Administration for Lawyers

Legal technology is rapidly evolving. Future trends include:

-

AI-assisted document review

-

Automated compliance monitoring

-

Enhanced client portals

-

Data-driven estate insights

Estate admin software for lawyers will continue to play a central role in modern legal practice.

Why Law Firms Are Adopting Estate Admin Software

Law firms that adopt estate admin software gain a competitive advantage by:

-

Delivering faster services

-

Reducing compliance risks

-

Handling more cases efficiently

-

Enhancing professional credibility

In an increasingly digital legal environment, technology adoption is no longer optional.

Final Thoughts: Is Estate Admin Software Worth It?

Absolutely. Estate admin software for lawyers is a strategic investment that improves efficiency, compliance, and client satisfaction. Whether you’re a solo practitioner or a growing law firm, the right estate administration software can transform how you manage probate and estate matters.