EstateAdmin Kit for Financial Advisors: A Complete Guide to Smarter Estate Administration

Estate administration is one of the most complex and emotionally sensitive processes your clients will ever face. As a financial advisor, you’re often the first professional they turn to when a loved one passes away. However, managing estate tasks manually—documents, beneficiaries, assets, liabilities, deadlines, and communication—can quickly become overwhelming.

This is where the EstateAdmin Kit for financial advisors becomes a game-changing solution.

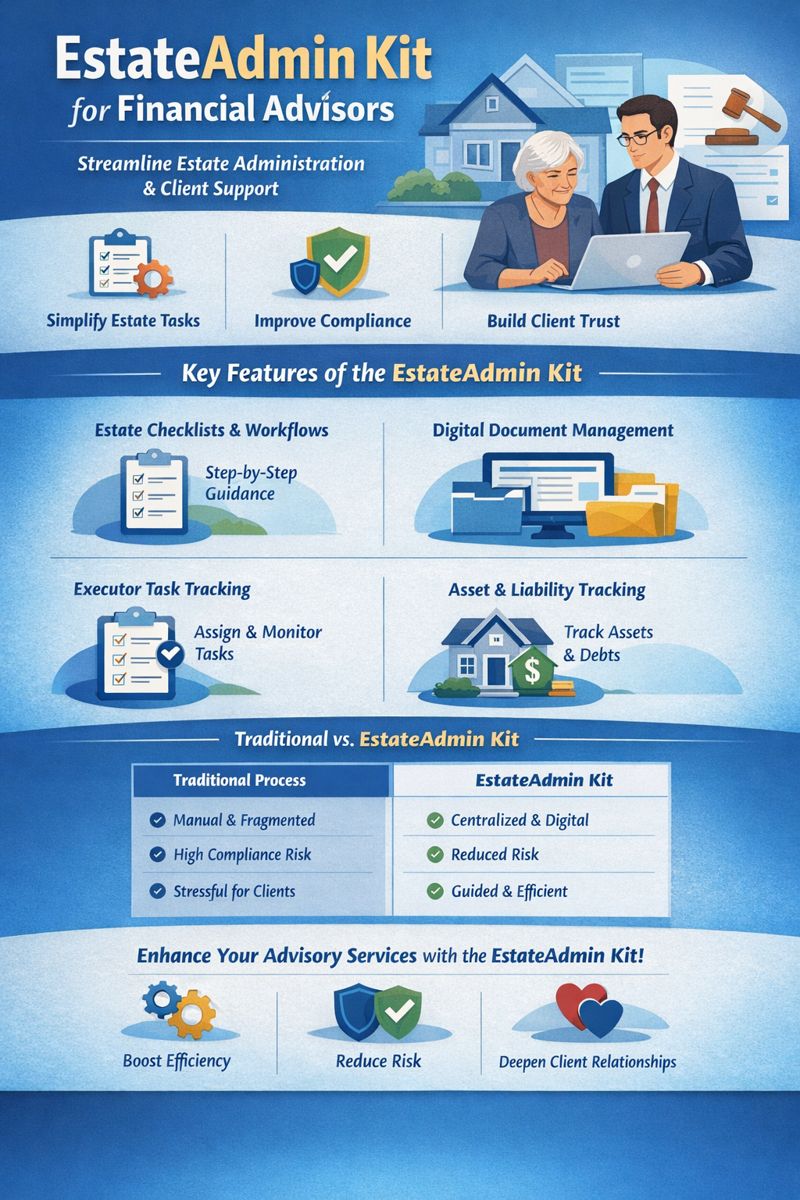

Designed to streamline estate administration, improve compliance, and strengthen advisor–client relationships, the EstateAdmin Kit equips financial advisors with structured workflows, digital tools, and ready-to-use templates that simplify every step of estate settlement.

What Is the EstateAdmin Kit for Financial Advisors?

The EstateAdmin Kit for financial advisors is a comprehensive estate administration toolkit that helps advisors guide executors, beneficiaries, and families through the estate settlement process efficiently and professionally.

It typically includes:

-

Estate administration checklists

-

Digital document organization tools

-

Executor task management workflows

-

Asset and liability tracking templates

-

Compliance-ready reporting frameworks

-

Client communication guides

Rather than replacing legal or tax professionals, the EstateAdmin Kit complements your advisory services by providing structure, clarity, and oversight during estate settlement.

Why Financial Advisors Need an EstateAdmin Kit

1. Estate Administration Is a Growing Advisory Responsibility

As wealth transfers increase globally, clients expect financial advisors to assist beyond investment management. Estate administration support is now a key value-added service.

2. Manual Processes Create Risk

Without standardized tools, advisors risk:

-

Missed deadlines

-

Incomplete documentation

-

Poor client communication

-

Compliance exposure

An EstateAdmin Kit eliminates guesswork and reduces operational risk.

3. Stronger Client Trust and Retention

Helping families during emotionally difficult times builds lifelong trust and significantly improves client retention across generations.

Core Features of an EstateAdmin Kit for Financial Advisors

Structured Estate Administration Workflow

The kit provides step-by-step guidance from:

-

Notification of death

-

Asset identification

-

Debt settlement

-

Beneficiary distribution

-

Final reporting and closure

This ensures no critical task is overlooked.

Digital Estate Document Management

Centralize all estate-related documents such as:

-

Wills and trusts

-

Death certificates

-

Title deeds

-

Bank statements

-

Insurance policies

Digital organization saves time and reduces errors.

Executor Task Management Tools

Executors often feel overwhelmed. The EstateAdmin Kit allows advisors to:

-

Assign tasks

-

Track progress

-

Set deadlines

-

Monitor completion status

This keeps the estate settlement process moving efficiently.

Asset & Liability Tracking

Financial advisors can clearly document:

-

Bank accounts

-

Investments

-

Real estate

-

Business interests

-

Outstanding debts

This improves transparency and simplifies final distributions.

Compliance & Audit Readiness

The EstateAdmin Kit supports:

-

Regulatory compliance

-

Internal audits

-

Accurate record-keeping

This is especially important for regulated financial advisory firms.

Key Benefits of EstateAdmin Kit for Financial Advisors

Improved Operational Efficiency

Automated workflows and templates reduce administrative workload, freeing advisors to focus on strategic guidance.

Enhanced Client Experience

Clients appreciate clarity, structure, and proactive communication during estate settlement.

Reduced Legal & Compliance Risk

Documented processes reduce the likelihood of disputes, errors, or regulatory issues.

New Revenue Opportunities

The EstateAdmin Kit enables advisors to:

-

Offer estate administration support as a premium service

-

Bundle estate planning and settlement services

-

Deepen multi-generational client relationships

Professional Differentiation

Financial advisors using estate administration tools stand out in a crowded advisory market.

Who Should Use the EstateAdmin Kit?

The EstateAdmin Kit for financial advisors is ideal for:

-

Independent financial advisors

-

Wealth managers

-

Financial planning firms

-

Private bankers

-

Family office advisors

-

Retirement planners

-

Trust and estate consultants

How Financial Advisors Use the EstateAdmin Kit in Practice

Step 1: Client Onboarding After a Loss

The advisor introduces the EstateAdmin Kit to the executor or family, explaining the estate settlement roadmap.

Step 2: Asset & Document Collection

All financial and legal documents are uploaded and categorized.

Step 3: Task Assignment & Tracking

Executors and professionals receive clear responsibilities with timelines.

Step 4: Ongoing Monitoring

The advisor monitors progress, resolves issues, and coordinates with lawyers and accountants.

Step 5: Estate Closure & Reporting

The estate is finalized with complete records and transparent reporting.

EstateAdmin Kit vs Traditional Estate Administration

| Feature | Traditional Process | EstateAdmin Kit |

|---|---|---|

| Organization | Manual & fragmented | Centralized & digital |

| Transparency | Limited | Full visibility |

| Task Tracking | Informal | Structured |

| Compliance | High risk | Reduced risk |

| Client Experience | Stressful | Guided & professional |

SEO Advantages for Financial Advisory Firms

Using an EstateAdmin Kit also supports your digital marketing strategy:

-

Content creation around estate settlement

-

Lead magnets for estate planning clients

-

Enhanced authority in estate advisory niches

-

Improved website conversions

Why EstateAdmin Kit Is Essential for Modern Financial Advisors

Today’s clients expect more than portfolio performance. They want guidance through life’s most critical transitions. The EstateAdmin Kit for financial advisors positions you as a trusted partner during estate settlement, not just an investment manager.

By adopting estate administration tools, financial advisors can:

-

Strengthen client relationships

-

Reduce operational complexity

-

Improve compliance

-

Create long-term business growth

Final Thoughts

The EstateAdmin Kit for financial advisors is no longer optional—it’s a strategic necessity in modern wealth management. As estates grow more complex and client expectations increase, structured estate administration tools provide the clarity, efficiency, and professionalism advisors need to succeed.

If your goal is to deliver exceptional client service, protect your firm, and stand out in the financial advisory market, the EstateAdmin Kit is the solution.

Leave a Reply