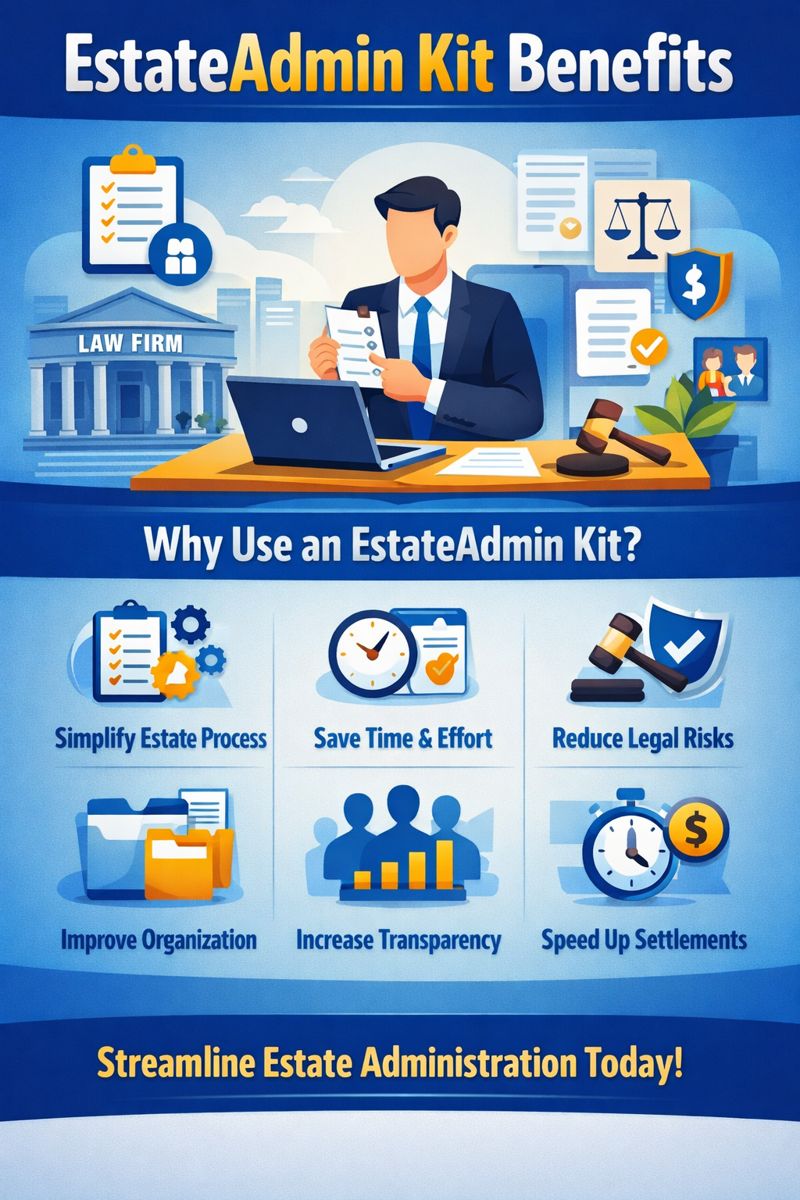

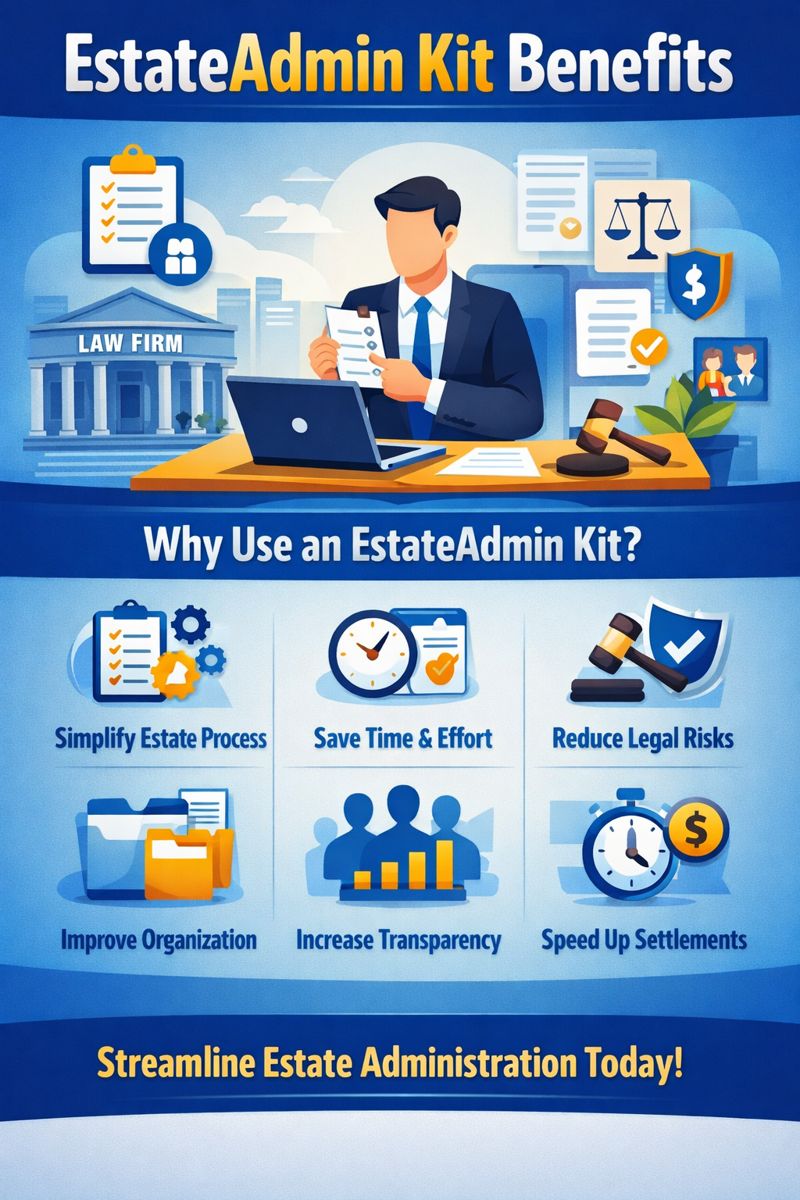

EstateAdmin Kit Benefits: Why It’s Essential for Modern Estate Administration

EstateAdmin Kit Benefits: Why It’s Essential for Modern Estate Administration

Managing an estate can be overwhelming. Executors, beneficiaries, legal professionals, and financial advisors often face complex documentation, strict timelines, and emotional pressure. This is where the EstateAdmin Kit becomes a game-changer.

Understanding the EstateAdmin Kit benefits helps individuals and firms streamline estate administration, reduce errors, and ensure a smooth estate settlement process. In this guide, we’ll explore how an EstateAdmin Kit simplifies estate management and why it’s becoming an essential tool in today’s digital estate workflows.

What Is an EstateAdmin Kit?

An EstateAdmin Kit is a structured set of tools, templates, and workflows designed to guide executors and professionals through the estate administration process. It typically includes:

-

Estate documentation templates

-

Executor task checklists

-

Asset and liability tracking tools

-

Beneficiary management workflows

-

Compliance and reporting support

The goal is simple: reduce complexity and increase efficiency.

Key EstateAdmin Kit Benefits Explained

1. Simplifies the Entire Estate Administration Process

One of the biggest EstateAdmin Kit benefits is process simplification. Estate administration often involves dozens of tasks—notifications, asset inventories, debt settlement, and legal filings.

An EstateAdmin Kit:

-

Breaks tasks into step-by-step actions

-

Eliminates guesswork for executors

-

Provides a clear roadmap from start to finish

This structured approach ensures nothing important is overlooked.

2. Saves Time for Executors and Professionals

Time delays in estate settlement can cause frustration and financial losses. The EstateAdmin Kit significantly reduces administration time by:

-

Centralizing documents in one place

-

Automating repetitive workflows

-

Providing ready-to-use templates

Executors no longer need to create documents from scratch or search for missing information.

3. Reduces Legal and Compliance Risks

Estate administration errors can lead to disputes, penalties, or legal action. Another major EstateAdmin Kit benefit is risk reduction.

The kit helps by:

-

Ensuring compliance with estate laws and procedures

-

Standardizing documentation formats

-

Tracking deadlines and obligations

This is especially valuable for law firms and estate planners handling multiple estates.

4. Improves Organization and Documentation Accuracy

Estate administration involves sensitive and critical data. An EstateAdmin Kit enhances document organization by:

-

Categorizing assets, liabilities, and beneficiaries

-

Maintaining consistent records

-

Reducing duplication and missing files

Better organization leads to faster approvals and fewer disputes.

5. Enhances Transparency for Beneficiaries

Miscommunication often causes tension among beneficiaries. One overlooked EstateAdmin Kit benefit is improved transparency.

With a structured system:

-

Beneficiaries receive clear updates

-

Records are easier to explain and audit

-

Trust between executors and beneficiaries improves

Transparency minimizes conflicts and misunderstandings.

6. Supports Digital Estate Management

Modern estate administration is shifting toward digital solutions. An EstateAdmin Kit supports digital estate filing and management, enabling:

-

Secure storage of estate records

-

Easy access for authorized users

-

Faster document sharing

This is especially useful for remote teams or estates involving international assets.

7. Ideal for Law Firms and Estate Planning Professionals

For professionals, EstateAdmin Kit benefits go beyond convenience. It enhances service delivery and scalability.

Law firms and advisors benefit from:

-

Standardized workflows across clients

-

Faster case handling

-

Professional, repeatable estate processes

This improves client satisfaction and operational efficiency.

8. Reduces Stress During a Difficult Time

Estate administration often follows the loss of a loved one. The EstateAdmin Kit reduces emotional burden by:

-

Providing clear guidance

-

Eliminating confusion

-

Offering structured support

This makes the process more manageable for non-professionals acting as executors.

9. Improves Estate Settlement Speed

Faster estate settlement is a key EstateAdmin Kit benefit. By organizing tasks and documents efficiently, estates can be settled quicker, allowing beneficiaries to receive distributions without unnecessary delays.

10. Cost-Effective Estate Administration Solution

Traditional estate administration often involves high legal and administrative costs. An EstateAdmin Kit helps reduce expenses by:

-

Minimizing manual labor

-

Preventing costly errors

-

Reducing back-and-forth with professionals

This makes it a cost-effective solution for both individuals and firms.

Who Benefits Most from an EstateAdmin Kit?

The EstateAdmin Kit benefits a wide range of users, including:

-

Executors and personal representatives

-

Law firms and legal practitioners

-

Estate planners and financial advisors

-

Trust administrators

-

Families managing private estates

Whether handling one estate or many, the kit adapts to different needs.

EstateAdmin Kit Benefits vs Traditional Estate Management

| Feature | Traditional Method | EstateAdmin Kit |

|---|---|---|

| Organization | Manual & scattered | Centralized |

| Speed | Slow | Fast |

| Accuracy | Error-prone | Structured |

| Transparency | Limited | High |

| Compliance | Risky | Guided |

| Cost | High | Optimized |

Why EstateAdmin Kits Are the Future of Estate Administration

As estates grow more complex and digital transformation accelerates, the demand for efficient tools increases. The EstateAdmin Kit addresses modern challenges by combining automation, compliance, and clarity.

This makes it a future-ready solution for estate administration worldwide.

Final Thoughts: Why EstateAdmin Kit Benefits Matter

The EstateAdmin Kit benefits go far beyond simple organization. They transform estate administration into a clear, efficient, and reliable process. From saving time and reducing risk to improving transparency and cutting costs, the EstateAdmin Kit is an essential tool for anyone involved in estate management.

If you’re looking to modernize estate administration, reduce stress, and improve outcomes, adopting an EstateAdmin Kit is a smart and strategic move.

Real-World Use Cases of EstateAdmin Kit Benefits

Estate Executors Managing Personal Estates

For individuals appointed as executors, the EstateAdmin Kit acts as a step-by-step guide. It eliminates uncertainty by clearly outlining responsibilities such as asset identification, creditor notifications, and beneficiary communication.

Key benefit: Executors avoid costly mistakes and gain confidence throughout the process.

Law Firms Handling Multiple Estate Cases

Law firms benefit from workflow standardization. With an EstateAdmin Kit, firms can:

-

Handle more cases efficiently

-

Reduce staff training time

-

Ensure consistent service delivery

Key benefit: Increased profitability and improved client trust.

Financial Advisors & Estate Planners

Estate planners use the kit to integrate estate administration into broader financial planning. The EstateAdmin Kit benefits advisors by:

-

Providing structured documentation

-

Supporting compliance requirements

-

Enhancing long-term client relationships

Key benefit: Advisors deliver holistic estate solutions.

How EstateAdmin Kit Benefits Improve Collaboration

Estate administration often involves multiple stakeholders—lawyers, accountants, executors, and beneficiaries. One overlooked benefit is collaboration efficiency.

The EstateAdmin Kit:

-

Centralizes shared information

-

Reduces repetitive communication

-

Keeps everyone aligned on progress

This leads to faster decision-making and fewer disputes.

EstateAdmin Kit Benefits for Record Keeping & Audits

Accurate records are critical in estate administration. The EstateAdmin Kit ensures:

-

Clear audit trails

-

Well-documented decisions

-

Easy reporting for legal or tax reviews

SEO Insight: This benefit appeals strongly to compliance-focused search intent.

Digital Security as a Core EstateAdmin Kit Benefit

Estate information is sensitive. A modern EstateAdmin Kit prioritizes:

-

Secure document storage

-

Controlled access permissions

-

Reduced risk of data loss

This makes it safer than paper-based or scattered digital systems.

Customization & Scalability Benefits

Another advantage is flexibility. EstateAdmin Kits can be customized to suit:

-

Small family estates

-

High-net-worth estates

-

Corporate and trust-based estates

As workload grows, the system scales without adding chaos.

EstateAdmin Kit Benefits for Reducing Family Disputes

Disputes often arise from lack of clarity. By maintaining transparent records and timelines, the EstateAdmin Kit:

-

Clarifies distributions

-

Documents executor actions

-

Reduces emotional conflicts

This is one of the most valuable non-financial benefits.

Common Challenges Solved by EstateAdmin Kits

Without an EstateAdmin Kit:

-

Missed deadlines

-

Lost documents

-

Confusion over responsibilities

-

High legal costs

With an EstateAdmin Kit:

-

Clear timelines

-

Organized workflows

-

Reduced errors

-

Faster settlements

SEO-Optimized FAQ Section (High Ranking Potential)

What are the main EstateAdmin Kit benefits?

The main benefits include simplified estate administration, reduced legal risk, improved documentation, faster estate settlement, and enhanced transparency for beneficiaries.

Is an EstateAdmin Kit suitable for first-time executors?

Yes. One of the biggest EstateAdmin Kit benefits is guiding first-time executors through complex estate tasks step by step.

Can law firms use EstateAdmin Kits?

Absolutely. Law firms use EstateAdmin Kits to standardize workflows, improve efficiency, and manage multiple estate cases effectively.

Does an EstateAdmin Kit reduce estate administration costs?

Yes. By minimizing errors, delays, and manual work, an EstateAdmin Kit significantly reduces administrative and legal costs.

Are EstateAdmin Kits secure?

Modern EstateAdmin Kits are designed with secure digital storage and controlled access, making them safer than traditional paper-based systems.

EstateAdmin Kit Benefits for SEO & Online Visibility (For Platforms)

If you’re offering an EstateAdmin Kit online, highlighting these benefits improves:

-

Search engine rankings

-

Conversion rates

-

Trust and authority

Search engines favor content that clearly explains value and user intent—this topic does exactly that.

Call to Action: Why You Should Use an EstateAdmin Kit Today

Estate administration doesn’t have to be complex or stressful. By leveraging the full EstateAdmin Kit benefits, individuals and professionals can manage estates efficiently, securely, and confidently.

Whether you’re an executor, lawyer, or estate planner, adopting an EstateAdmin Kit means:

-

Less stress

-

Faster results